Introduction

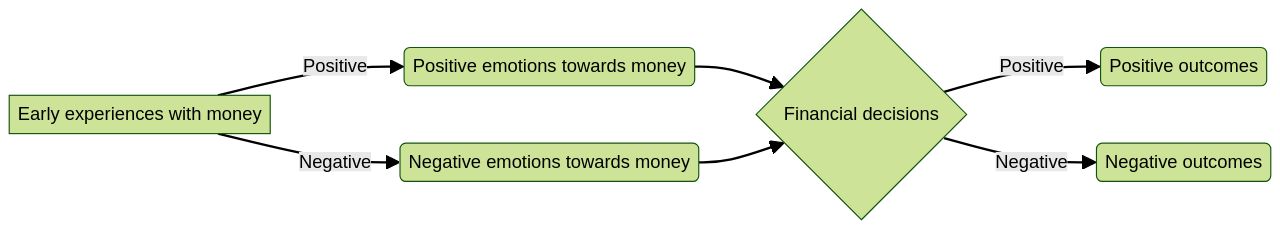

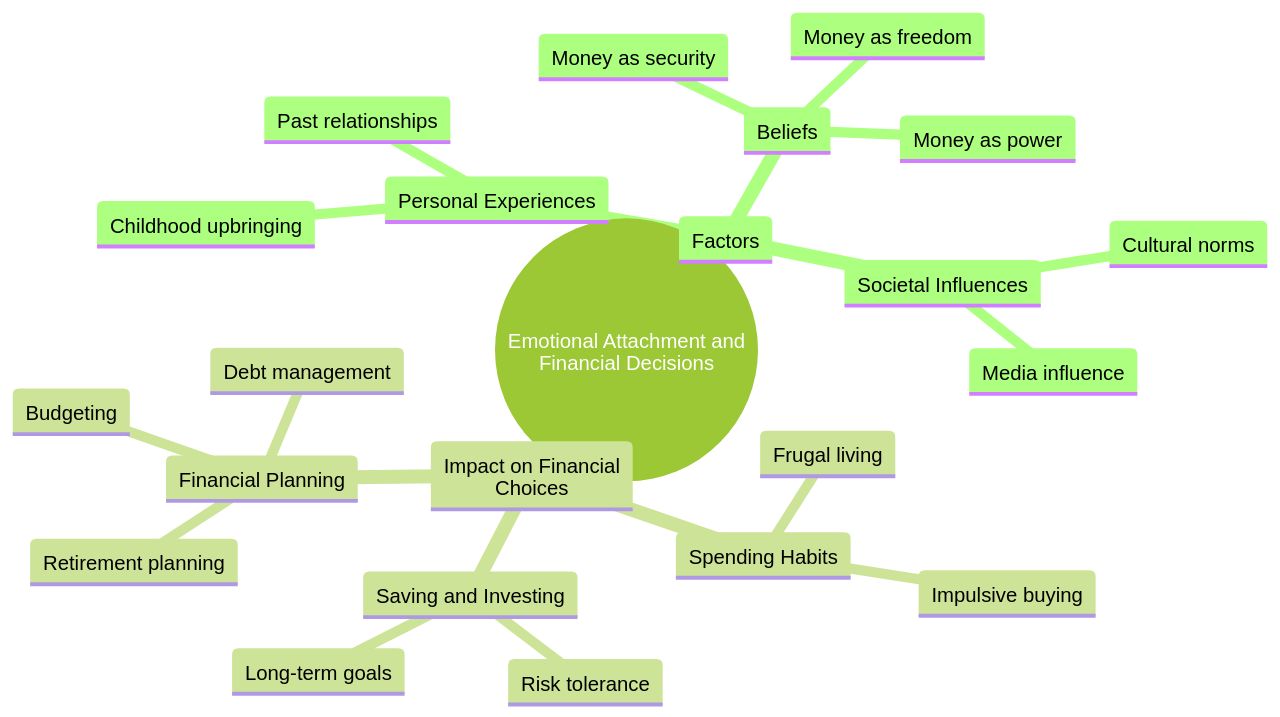

The intricate relationship we have with money is deeply rooted in our emotional experiences and perceptions. This bond, often formed in the early stages of our lives, significantly influences our financial decisions. For some, money might represent security, power, or love, fostering a deep emotional connection. Understanding and managing this emotional bond is key to making better financial decisions. It's not the money itself that matters, but the meaning we ascribe to it.

Research shows that our financial choices are largely driven by emotions - almost 90% of our decisions about money are emotionally charged. Money is intrinsically tied to our life experiences. For instance, financial trauma, which can result from distressing money-related experiences, can have a significant impact on our financial and mental wellbeing. Symptoms of financial trauma can mimic those of post-traumatic stress disorder, such as negative thoughts, anxiety, and flashbacks. This trauma can originate from various sources such as medical debt, financial insecurity, and economic crises.

A notable example of this is the survivors of the Great Depression, who were less likely to invest in the stock market due to fear of another crash, thereby affecting their retirement savings. Trauma can also be intergenerational, manifesting in different ways such as inheriting your parents' debt. For instance, a financial coach and consultant, Mr. Sabree, recalls his teenage years living in subsidized housing and paying for groceries with food stamps. “When things got really bad, we went without electricity and water,” he said. The fear of eviction and the subsequent financial instability led to anxiety around spending money, even on necessities.

ASD Media, a company that provides valuable insights on managing emotional attachment to money, emphasizes that our emotional bond with money can manifest differently in different individuals. Some might follow the financial behavior they observed growing up, while others might develop a completely different mindset. In both cases, emotions are the primary drivers. For instance, those who avoid money often view wealth with disdain. This negative association with money can lead to unconscious self-sabotage of finances by neglecting anything related to money management. Beliefs like 'rich people are greedy' or 'it's not okay to have more than you need' can hinder financial growth.

Conversely, some individuals equate self-worth with net worth, believing that people need to see their wealth. This mindset often leads to lifestyle creep, where individuals live paycheck to paycheck even as their income increases. These behaviors are often driven by the need for approval and love. Before making an expensive purchase, it's essential to introspect why you're buying it and how it fits into your budget.

Our relationship with money is complex and multi-dimensional. It's a journey of inner child healing, nervous system regulation, and understanding our ancestors' money stories. Recognizing and acknowledging our emotional attachment to money is the first step towards a healthier financial life. ASD Media offers unlimited digital access resources that can help individuals understand and overcome emotional attachment to money. These resources provide valuable insights and strategies for managing finances and developing a healthier relationship with money. With subscription options available at $5-7 per month or $130 per year, ASD Media aims to provide practical guidance and resources for individuals seeking to navigate the emotional aspects of money management.

1. Understanding Emotional Attachment to Money

The intricate relationship we have with money is deeply rooted in our emotional experiences and perceptions. This bond, often formed in the early stages of our lives, significantly influences our financial decisions. For some, money might represent security, power, or love, fostering a deep emotional connection. Understanding and managing this emotional bond is key to making better financial decisions.

It's not the money itself that matters, but the meaning we ascribe to it.

Research shows that our financial choices are largely driven by emotions - almost 90% of our decisions about money are emotionally charged. Money is intrinsically tied to our life experiences. For instance, financial trauma, which can result from distressing money-related experiences, can have a significant impact on our financial and mental wellbeing. Symptoms of financial trauma can mimic those of post-traumatic stress disorder, such as negative thoughts, anxiety, and flashbacks. This trauma can originate from various sources such as medical debt, financial insecurity, and economic crises.

A notable example of this is the survivors of the Great Depression, who were less likely to invest in the stock market due to fear of another crash, thereby affecting their retirement savings. Trauma can also be intergenerational, manifesting in different ways such as inheriting your parents' debt. For instance, a financial coach and consultant, Mr. Sabree, recalls his teenage years living in subsidized housing and paying for groceries with food stamps. “When things got really bad, we went without electricity and water,” he said. The fear of eviction and the subsequent financial instability led to anxiety around spending money, even on necessities.

ASD Media, a company that provides valuable insights on managing emotional attachment to money, emphasizes that our emotional bond with money can manifest differently in different individuals. Some might follow the financial behavior they observed growing up, while others might develop a completely different mindset. In both cases, emotions are the primary drivers. For instance, those who avoid money often view wealth with disdain. This negative association with money can lead to unconscious self-sabotage of finances by neglecting anything related to money management. Beliefs like 'rich people are greedy' or 'it's not okay to have more than you need' can hinder financial growth.

Conversely, some individuals equate self-worth with net worth, believing that people need to see their wealth. This mindset often leads to lifestyle creep, where individuals live paycheck to paycheck even as their income increases. These behaviors are often driven by the need for approval and love. Before making an expensive purchase, it's essential to introspect why you're buying it and how it fits into your budget.

Our relationship with money is complex and multi-dimensional.

It's a journey of inner child healing, nervous system regulation, and understanding our ancestors' money stories. Recognizing and acknowledging our emotional attachment to money is the first step towards a healthier financial life. ASD Media offers unlimited digital access resources that can help individuals understand and overcome emotional attachment to money.

These resources provide valuable insights and strategies for managing finances and developing a healthier relationship with money. With subscription options available at $5-7 per month or $130 per year, ASD Media aims to provide practical guidance and resources for individuals seeking to navigate the emotional aspects of money management.

2. Recognizing the Signs of Emotional Spending

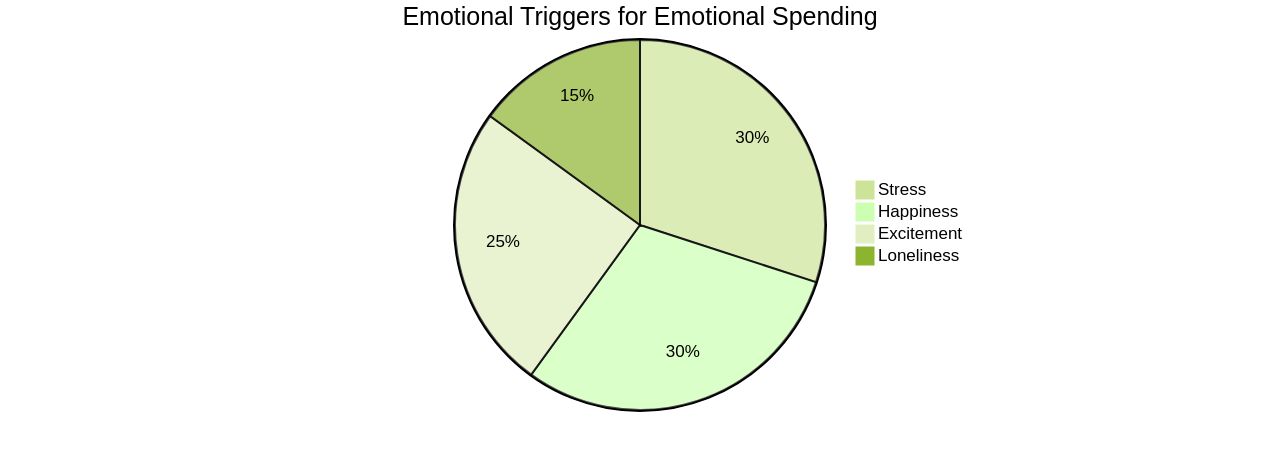

Emotional spending, often triggered as a response to both negative emotions like stress and loneliness, and positive ones such as excitement and happiness, is a pattern that can lead to financial instability.

This behavior, which can manifest as impulsive buying or feelings of regret after purchase, is often driven by the thrill of acquiring something new. Recognizing these signs is crucial as they significantly impact your financial behaviors.

Notably, the emotional triggers for spending are not limited to negative feelings. Positive emotions like excitement and happiness can also instigate spending sprees. Statistics show that 44% of people spend more when excited, and 38% do so when happy. Furthermore, 54% of individuals are more likely to spend when in a good mood, illustrating the intricate emotional dynamics that influence our financial decisions.

Although the initial emotional stimulus leading to the spending may be negative, the act of purchasing often provides a sense of exhilaration. However, the potential financial repercussions of emotional spending can be serious and far-reaching. With nearly 40% of emotional spenders reporting debt accumulation due to their spending habits, the strain this places on personal finances and relationships cannot be underestimated.

Acknowledging the existence of emotional spending is the first step towards mitigating its effects. Everyone may succumb to it on occasion, reinforcing the importance of vigilance and self-discipline in financial matters. ASD Media provides expert advice and resources to assist individuals in understanding and managing their emotional spending habits.

They offer unlimited digital access to their content through a subscription plan that ranges from $5-7 per month to $130 per year.

Financial stress can also be amplified by a lack of sufficient savings to cushion against financial volatility. According to a financial wellness survey by Bankrate, 56% of consumers stated that inadequate emergency savings negatively affected their mental health. Almost half (44%) reported having less or no savings compared to the previous year. This financial stress can in turn lead to emotional spending as a coping mechanism, underscoring the importance of establishing an emergency fund, even if it's built up gradually.

ASD Media offers a wealth of resources to help individuals identify signs of emotional spending and foster healthier financial habits. Their subscription includes access to articles, videos, and tools aimed at enhancing financial understanding and promoting informed decision-making. By recognizing the signs of emotional spending, individuals can improve their financial well-being and achieve their financial objectives.

In summary, emotional well-being is a significant factor in our financial decisions. Therefore, it is essential to identify and manage emotional spending patterns to safeguard financial stability and overall well-being. ASD Media's resources provide a useful guide in this journey towards financial literacy and empowerment.

3. The Impact of Emotional Attachment on Financial Decisions

Our emotional state significantly influences our financial decisions, often leading us down a path that may not serve our best financial interests. For instance, an individual who links money with security may hoard wealth excessively, neglecting necessary expenditures. Conversely, a person who sees money as a symbol of success might overspend to maintain a certain lifestyle. By understanding the emotional ties to our financial choices, we can foster healthier financial habits.

Although the role of emotions in decision-making has been widely discussed in psychology and marketing, it has been largely overlooked in financial literature. Emotions, particularly positive ones such as trust and optimism, have been found to significantly shape investors' reactions. Interestingly, the emotional influence derived from news media impacts stock valuations more than those based on social media.

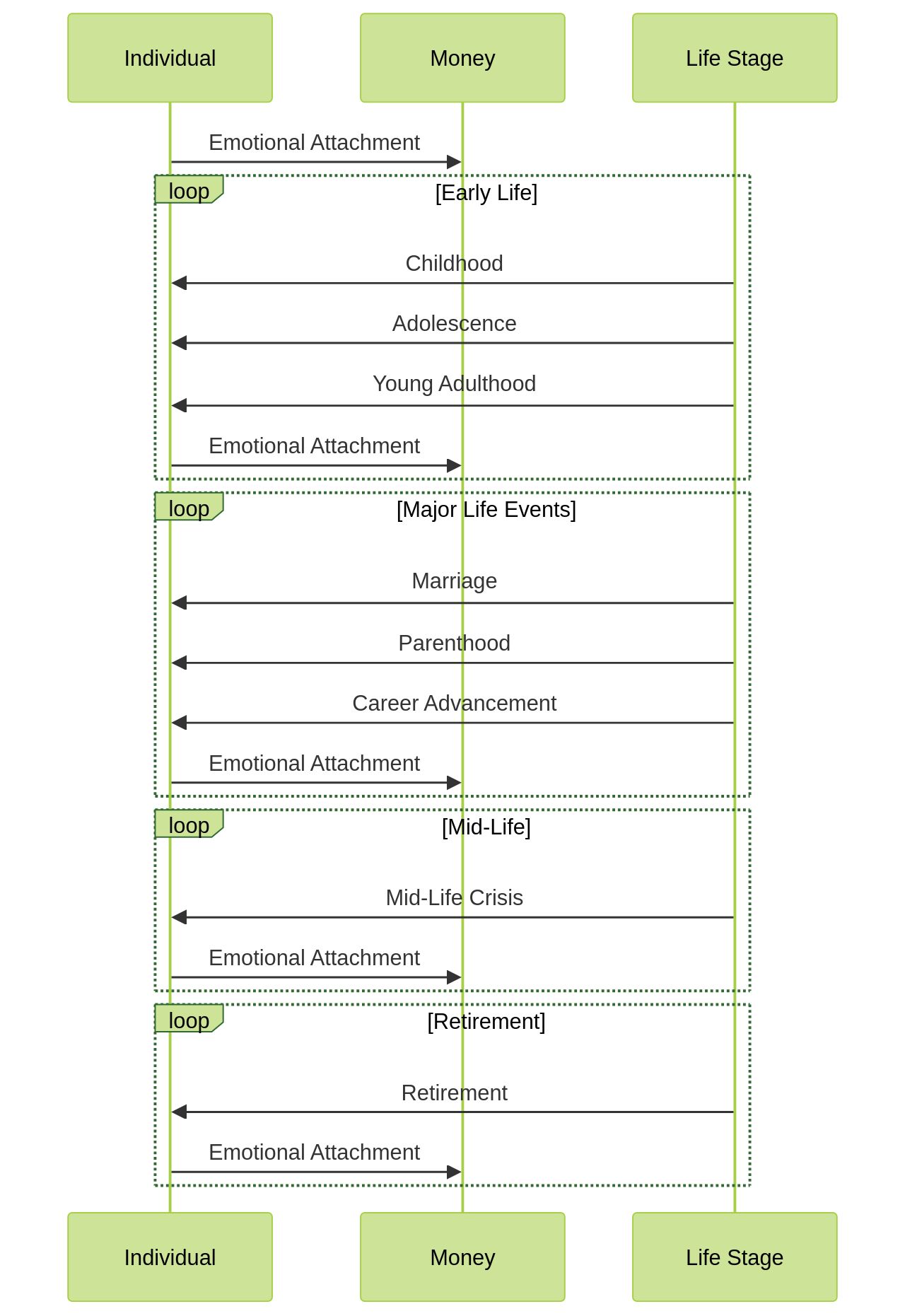

Our emotional relationship with money also changes over time, influenced by various life stages and events.

For example, a study by Equitable, a leading financial services company, revealed that women's financial decision-making becomes more purposeful over their lifetime, with specific life events acting as catalysts for increased financial involvement.

To make the most beneficial long-term financial choices, it's helpful to list frequent expenses and identify which purchases continue to provide fulfillment long after the initial buying pleasure has faded. This exercise can help us direct our spending towards more meaningful and satisfying avenues.

However, it's crucial to remember that our inherent emotional biases can lead us to make irrational financial decisions. For example, people typically prefer a small guaranteed win over a probable but not assured larger win in the context of gains. Yet, when it comes to losses, people are more willing to take a risk to avoid a certain loss, indicating an irrational bias towards loss aversion.

Moreover, it's important to understand that money status beliefs, which equate personal value with financial value, can lead to unhealthy spending habits. Consequently, such beliefs can lead to unnecessary spending to maintain a perceived status, ultimately causing financial stress.

In this context, ASD Media provides expert advice to navigate emotional attachment to money, offering insights and strategies to overcome emotional barriers and make rational financial decisions. ASD Media emphasizes understanding one's emotional relationship with money and its impact on financial choices. Subscribers have unlimited digital access to ASD Media's resources, including articles, guides, and possibly online courses, that help develop a healthier mindset towards money. The subscription is priced at $5-7 per month or $130 per year, offering unlimited digital access at a discounted rate.

The role of a financial advisor, such as those at ASD Media, is critical as they can provide unbiased advice, enabling us to make rational financial decisions. Interestingly, financial advisors are often better at managing their clients' money than their own, highlighting the importance of an external perspective in financial decision-making.

In essence, understanding the emotional bonds we form with money and how they affect our financial decisions is the first step towards developing healthier financial habits. By identifying our emotional triggers, we can make more informed and rational financial decisions that contribute to our long-term financial stability.

4. Strategies for Managing Emotions and Finances

The journey of deciphering complex emotions and managing finances may seem intimidating, but it is certainly manageable. Identifying emotional triggers that result in impulsive spending is a key step. ASD Media provides resources that help in understanding and overcoming such emotional triggers that influence financial decisions. These resources are accessible through a subscription, available at $5-7 per month or $130 per year, and offer valuable insights for better financial decision-making.

Before making any purchase, a moment of introspection can prevent unnecessary spending. Questions like whether the purchase is driven by an emotional impulse or a genuine need can be a helpful reality check. ASD Media's expert advice includes distinguishing between emotional needs and genuine necessities, aiding in making more responsible financial choices.

Creating a budget that aligns with your financial goals adds a sense of realism and flexibility to financial planning. ASD Media guides on creating such a budget, tracking expenses, and adjusting the budget as needed. This guidance is aimed at helping individuals gain control of their finances and achieve stability.

It's important to acknowledge that everyone encounters moments of struggle. During these times, seeking assistance from a financial advisor or a trusted friend can be beneficial. Similarly, many communities offer free or low-cost financial assistance for debt recovery, budgeting, and saving. Additionally, a fee-based financial advisor can provide a personalized financial plan that suits your needs.

Research indicates that individuals often turn to close friends or romantic partners for emotional support. A study involving 197 cohabiting romantic couples revealed that partners often help each other manage their emotions. The same principle applies to financial management, where seeking assistance from a financial advisor or a friend can be beneficial.

Financial stress is common, especially among individuals with lower incomes. A survey found that 59% of individuals with annual incomes of less than $50,000 reported feeling stressed about money, compared to 45% of those earning $100,000 or more. A well-thought-out financial plan can significantly reduce stress and improve overall financial health. Here, ASD Media's resources can prove to be valuable, providing insights and guidance for better financial management.

Emotional and financial management is a complex process demanding self-awareness, strategic planning, and the courage to seek help when needed. It's okay to feel overwhelmed and ask for help, as it's a part of the journey towards achieving emotional and financial stability.

5. Techniques to Detach Emotionally from Money

Redefining your relationship with money is a journey, not about diminishing its significance, but seeing it as a tool to accomplish your goals. It's about appreciating what you have and investing in life aspects that offer genuine happiness. Techniques like mindfulness and meditation can greatly alleviate financial stress.

Consider the story of Schneider and Auten, a couple who transformed their financial situation by shifting their perspective on money. Burdened with a $51,000 credit card debt and living in a leased basement apartment, they chose to confront their financial circumstances. They scrutinized their expenditures, identifying areas of overspending like dining out and clothing.

Through prioritizing their expenses and eliminating unnecessary ones, they eradicated their debt in under three years. But their journey didn't end there. In 2015, they founded Debt Free Guys, a platform to share their financial journey and offer financial education. Their net worth has since surpassed the $1 million threshold, proving that a shift in perspective can significantly improve financial wellbeing.

ASD Media also offers resources, available through a subscription of $5-7 per month or $130 per year, that can help individuals understand and overcome emotional attachment to money. The materials provide insights and strategies for developing a healthier relationship with money and understanding the difference between emotional wants and genuine needs, helping individuals make rational financial choices.

To better comprehend your relationship with money, consider a straightforward exercise. Write 'Money' on a piece of paper. Then, jot down everything that comes to mind when you think about money. This could be words, phrases, or even ingrained beliefs. The goal is to be brutally honest and understand your subconscious beliefs about money. This exercise can help you determine whether your association with money is positive or negative, serving as a starting point for change.

'Remember, money is a renewable resource', a concept created by humans, heavily influenced by our thoughts and belief systems. We can change our financial reality by shifting our mindset. When we use money to support creation and life, more tends to flow back to us. This isn't about reckless spending, but being generous in ways that feel right to you.

Many Americans face financial stress, with common issues being mounting expenses, debt obligations, and an inability to save. These financial stressors can cause anxiety and even disrupt sleep, particularly among younger generations. However, financial happiness isn't solely about wealth accumulation. It's about affording small luxuries without guilt, spending on experiences with loved ones, and living debt-free.

In essence, detaching emotionally from money doesn't mean disregarding its value. It's about understanding its role as a tool for achieving your goals, not as a determinant of happiness or security. It's about cultivating a healthier relationship with money, one that promotes financial well-being and reduces stress. ASD Media's resources can help in this journey toward a healthier financial mindset.

6. The Role of ABA Therapy in Financial Management

Applied Behavior Analysis (ABA) therapy, as utilized by ASD Media, is a comprehensive tool for navigating the intricate landscape of emotional attachment to money. It acts as a guide, aiding individuals in recognizing and understanding their behavioral patterns, pinpointing the triggers that ignite emotional spending, and creating effective strategies to control both their emotions and finances. This process of self-exploration and personal growth includes setting clear financial goals, consistently monitoring progress, and fostering positive financial behaviors.

ABA therapy, as offered by ASD Media, helps us comprehend the emotional roots of our financial behavior, which is like deciphering the enigmas of our minds. It sheds light on patterns of emotional spending, such as the impulse to 'spoil ourselves' despite the knowledge that it will result in stress and regret. Acknowledging this is an essential first step. It enables us to perceive these 'treats' for what they truly are - not luxuries, but 'anti-treats' that negatively impact our wellbeing.

In addition, ABA therapy encourages us to reassess our perception of the present and the future. We often overly value our immediate experiences, placing future consequences on the back burner. This mindset leads us to favor short-term satisfaction over long-term benefits, a pattern that can harm our financial health. ABA therapy, as provided by ASD Media, illuminates this mindset, allowing us to confront and modify these ingrained biases.

ABA therapy can also assist us in dealing with the aftermath of financial trauma, which can greatly influence our relationship with money. The residual effects of such trauma can discourage individuals from making wise financial decisions, such as investing for the future. It can also perpetuate a cycle of financial insecurity across generations. ABA therapy can illuminate these issues, promoting a healthier and more balanced view of money.

Moreover, ABA therapy underscores the significance of managing our emotions, a skill crucial to our overall success and wellbeing. It instructs us to identify and react to the emotions of others, promoting empathy and enhancing our interpersonal relationships. This emotional intelligence extends to our relationship with money, assisting us in maneuvering the emotional peaks and valleys that accompany financial decisions.

To sum up, ABA therapy, as provided by ASD Media, provides a comprehensive approach to managing emotional attachment to money.

It assists individuals in gaining a deeper understanding of their behaviors, confronting their fears, and building a healthier relationship with their finances. This therapeutic journey enables individuals to reform their financial habits, fostering a sense of control and confidence that reaches far beyond their wallets. ASD Media offers unlimited digital access to their ABA therapy services and resources, with subscription options available at $5-7 per month or $130 per year, making it accessible to many.

7. Case Studies: Success Stories of Overcoming Emotional Attachment to Money

Countless individuals have successfully navigated their emotional connections to money, thus charting a course towards financial freedom. Their stories serve not only as inspiration but also provide practical insights for those embarking on a similar journey. One such narrative is that of J.L. Collins, the author of 'Simple Path to Wealth.' Collins began his savings journey at the age of 13 and adopted a simple yet effective strategy - investing his savings in index funds. This approach granted him financial independence in his 30s, and by his 40s, he was ready to retire. However, for Collins, the pursuit of financial independence was not about retirement but about freedom - the freedom to choose work not for the sake of paying bills but for the joy of it. This is an aspiration many share, and Collins' story exemplifies that it is an achievable goal.

ASD Media's resources have played a pivotal role in helping individuals overcome emotional attachment to money and achieve financial stability. The platform provides success stories of individuals who, like Collins, have achieved financial stability. These inspiring narratives serve as a guiding light for others seeking to overcome their emotional attachment to money. ASD Media also offers practical advice and strategies for achieving financial stability, all backed up by testimonials from individuals who have reaped the benefits of their resources.

A quote that resonates with this concept is: 'As you continue your pursuit toward your authentic life, there will be things (and people) that you have grown attached to... The short-term discomfort, sadness, or pain of letting go keeps your attachment in place. But what you don’t realize is the short-term emotions will quickly fade, allowing you to replace the old with something new that is aligned with your authentic life.' This quote encapsulates the essence of emotional attachment to money and how letting go can lead to long-term happiness and benefit.

The journey to financial freedom is not just about financial strategies; it's also about managing emotional attachments. This process involves recognizing and confronting emotional triggers, practicing mindful spending, and seeking knowledge and advice when necessary. By doing so, we can move towards a life that is not dictated by financial constraints, but rather enriched by financial freedom. ASD Media provides unlimited digital access to such valuable resources for a subscription fee of $5-7 per month or $130 per year, thus making financial freedom an accessible goal for many.

8. Maintaining Financial Stability: Long-term Strategies and Tips

Maintaining financial stability is a dynamic, ongoing process that requires strategic planning, regular reassessments, and consistent efforts. This journey includes building a robust emergency fund, establishing a comprehensive budget, investing wisely, and staying updated about the latest financial trends and news.

The cornerstone of this financial journey is the creation of a strong emergency fund. Having immediate access to cash can shield your financial health from unexpected expenses, providing you the flexibility to plan for the coming months rather than just weeks. After recovering from a financial setback, it's crucial to replenish this fund to prepare for any future uncertainties. ASD Media offers resources that can help individuals save for emergencies and build a solid financial foundation. Their platform includes various tools and information related to personal finance, which can be accessed through their subscription plans.

Budgeting is another critical aspect of maintaining financial stability. A comprehensive overview of your cash flow can reveal your financial status and is instrumental in recovering from any financial setback. ASD Media provides effective strategies for regularly reviewing and adjusting your budget. Their detailed guide on budgeting can be accessed through their subscription service, assisting you in gaining control over your cash flow and instilling a sense of empowerment and confidence in your financial decisions.

Tax diversification is another strategy to protect your wealth from future changes in tax laws. By investing in asset classes or structures that may be immune to future increases in income or capital gains taxes, you can build the resilience needed to withstand changes in tax liability for your overall portfolio. ASD Media's expertise in finance enables them to provide tailored recommendations and personalized solutions to help individuals navigate this complex landscape.

A financial expert at ASD Media advocates for an approach centered on small, manageable steps towards financial stability. This method emphasizes cultivating consistency, patience, and setting achievable short-term objectives that cumulatively lead to significant long-term results. They suggest designating a family chief financial officer (CFO) responsible for a comprehensive assessment and ongoing monitoring of the family's financial status.

In the rapidly changing financial landscape, staying informed about global events that can impact markets is crucial. ASD Media offers unlimited digital access to resources and newsletters for staying updated on the latest financial news and trends. Their offerings help you understand how changes to the tax code, the impact of the pandemic on the labor market, changes in state spending forecasts, and potential adjustments in pension funds can influence your financial stability.

In essence, financial stability is a journey that requires commitment, discipline, and strategic planning. By taking small, consistent steps, leveraging the resources and advice provided by ASD Media, and staying informed about the changing financial landscape, you can navigate this journey with confidence and resilience.

9. Resources for Further Learning and Support

An abundance of resources are available to assist you in maneuvering the intricate relationship between emotions and finances. From all-encompassing financial literacy websites and insightful personal finance books to interactive online courses and professional financial advisors, the choices are vast.

One such resource is ASD Media, a platform that offers expert advice on managing emotional attachment to money and unlocking the potential of your finances. They offer a wealth of resources and guidance, aiming to help individuals develop a healthier relationship with money and make informed financial decisions. To facilitate access, ASD Media provides unlimited digital access to their resources, with two subscription options available: $5-7 per month or $130 per year.

Online communities also present a precious opportunity to learn from shared experiences and insights from those navigating similar paths. One such community is the Forum, an online peer support model that allows small business owners without the means for one-on-one counseling to connect with others in a similar situation.

Investment newsletters, like those provided by ASD Media, can also serve as a valuable resource in your financial journey. They offer market analyses, investment recommendations, and insights into financial trends. However, it is vital to remember that these newsletters should not be your sole source of financial decisions, but rather a tool to enhance your understanding of the financial world.

When it comes to personal finance books, 'No Worries' by Jared is one that stands out. This book serves as a guidebook for each phase of life, offering practical advice on a range of topics from education choices and house buying to managing credit card debt and daily purchases.

Remember, managing your emotions and finances can be challenging, but you're not alone. Working with professionals can help create a plan tailored to your unique financial situation and track your progress, reducing your financial stress. As one professional noted, 'Having a plan for your money situation and keeping tabs on that plan can help lower your financial stress.'

In the end, seeking help and learning from others is not a sign of weakness but a sign of strength. It's about taking control of your financial well-being and making decisions that align with your goals and values.

Conclusion

In conclusion, our emotional attachment to money significantly influences our financial decisions. Research shows that almost 90% of our decisions about money are emotionally charged. Financial trauma and life experiences can shape our emotional bond with money, leading to behaviors such as fear of spending or equating self-worth with net worth. Recognizing and understanding these emotional attachments is crucial for making healthier financial choices.

Managing our emotions and developing a healthier relationship with money is a complex process that requires introspection and self-awareness. ASD Media offers valuable resources and insights to help individuals navigate their emotional attachment to money. With unlimited digital access available through subscription options, individuals can access practical guidance and strategies for managing finances and achieving financial well-being.

To embark on your journey towards a healthier financial life, start now by subscribing to ASD Media's resources .